Please Follow us on Gab, Minds, Telegram, Rumble, Gab TV, Truth Social, Gettr, Twitter

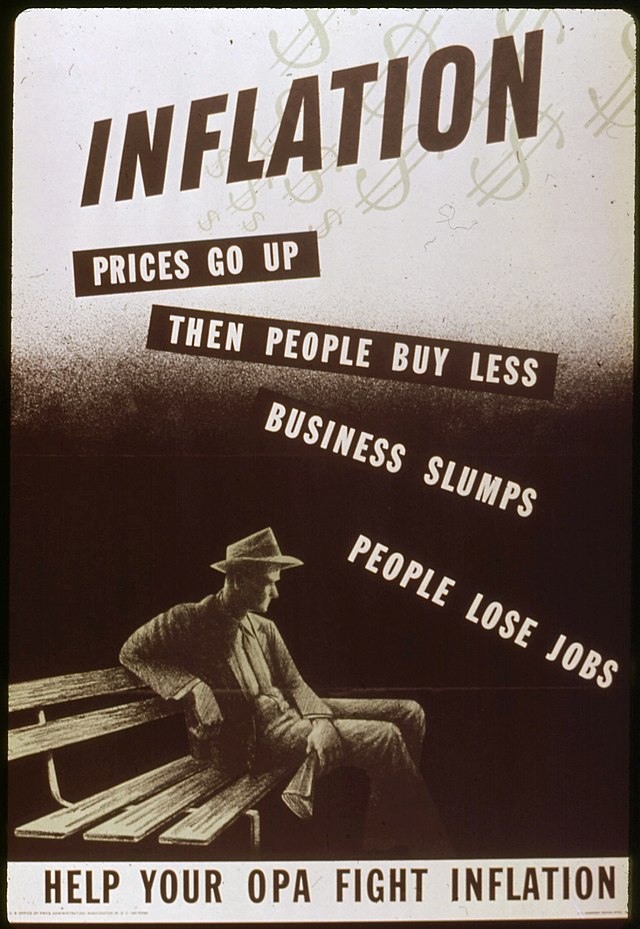

As the Federal Reserve Board meets this week to likely raise the discount rate another .25%, a red sun is rising on the fiscal horizon of America. A Financial time bomb is ticking. Inflation is running hot at approximately 5%, although it has come off last year's highs. The problem is that energy-related costs heavily affect Americans' overall inflation of goods prices. It has been estimated that energy cost increases translate 50% of their upward movements into actual price increases for retail consumers. Given those facts, we're looking at oil prices that have increased by over 20% in the last 30 days. This rise would indicate approximately another 10% percent inflation rate for the American consumer.

The other point we'd like to raise is that the national debt will be financed based on the rates determined by the Federal Reserve Bank. Currently, short-term rates are over 5%, and the Federal Reserve Bank has indicated that rates are up and will stay up to fight the raging inflation that has taken place ever since the Biden administration took over managing the economy. Last year, the interest paid on the national debt was approximately $325 billion. This payment equated to roughly a 1.5% interest rate on the national debt of about $25 trillion.1 Some explanation is in order as we are aware that the actual debt put out in the news is over $32 trillion. The fact is that almost $7 billion held by the Federal Reserve Bank does not have interest paid on the debt. This little-known fact is critical. It does mollify the rapidly rising amount that must be paid for the American National debt. The trend, however, is not good.

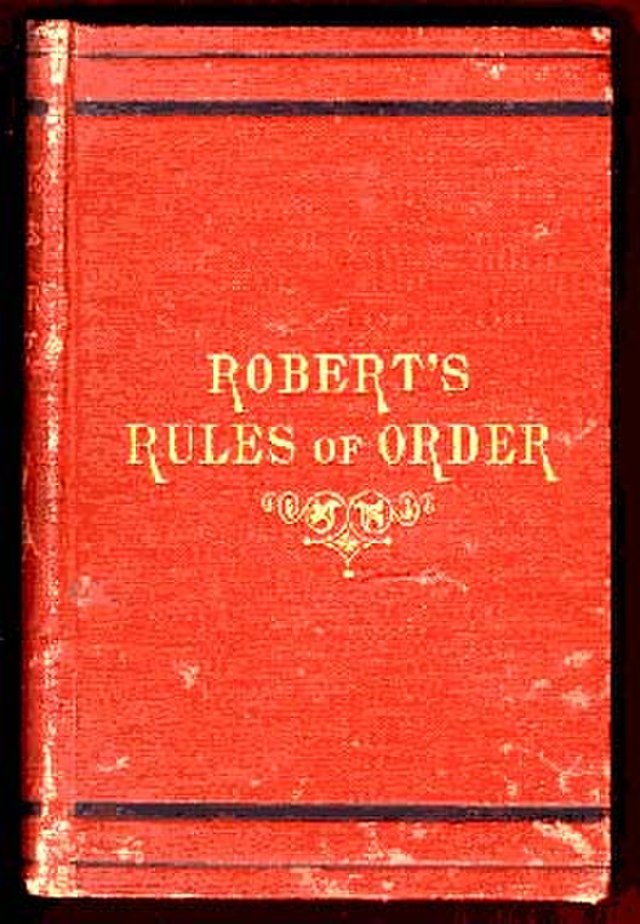

The above graph shows the path of inflation in the 1970s and the long, painful recovery that took place after President Ronald Reagan entered the White House in 1981. If the graph is similar to today, the dip in inflation in late 1976 would correlate. If that is the case, we are in for a wicked ride, with inflation heading up even more than in 2024.

Should inflation remain high, which appears to be an ever-increasing likelihood, the rate at which maturing bonds need to be refinanced on the national debt will increase from a low 1.5% rate up towards the 5% rate, which would mean approximately a 300% increase and the amount paid. So that $325 billion figure will now go to well over a trillion dollars. It will surpass the most oversized item in the federal budget, National Defense, by hundreds of billions of dollars. This debt will defeat all efforts at lowering the federal deficit and essentially make the goal of a balanced budget hopeless. Over $2 trillion of treasury notes are maturing between now and the end of 2023, with an average increase in interest rates of 100%, or over $40 billion more of our hard-earned American taxpayer dollars per year. Almost $5 Trillion in Treasury Bills are maturing, and all of them will go back out at higher rates.

Instead of decreasing its balance sheet of treasury debt, the Federal Reserve has increased its debt by $800 billion in the last year. This bond purchase is artificially propping up the national debt as the interest held by the Fed is a wash to the Treasuries balance sheet. The Treasury does not pay interest on that debt. It also stimulates the economy by increasing the money supply, which drives inflation higher and more money chasing too few goods. The stock market expects interest rates to drop very soon and likely no later than 2024. Capitalist investors do not see that inflation is with us for a long time. This lack of foresight could bode poorly for equity investments as we finish 2023 and go into 2024. Caution is always advisable for the retail investor, so why not enjoy short-term treasury bills paying over 5%? These are the lowest-risk investments regular investors can find.

- “Monthly Statement of the Public Debt (MSPD) | U.S. Treasury Fiscal Data.”

- “United States Consumer Price Index (CPI) YoY.”