Please Follow us on Gab, Minds, Telegram, Rumble, Truth Social, Gettr, Twitter

Guest post by Duggan Flanakin - CFACT Policy Analyst

Chase Ergen grew up watching his father, Charlie, build EchoStar and Dish Network into household names, and along the way, he learned much about how communications have changed with developments in technology.

The still-young entrepreneur has vowed to put his experience and resources to good use as both a pioneer and a champion of other pioneers in web3, blockchain, cryptocurrencies, non-fungible tokens (NFTs), all of which are enabling decentralized finance.

A visionary in his own right, Ergen says that decentralized finance is the future, and he has worked long and hard to position himself at the forefront of what has become a revolutionary movement in entrepreneurship in the 21st Century.

Today’s young entrepreneurs are about creating wealth while providing tools that respond to human demand for a future where every life matters.

The universe of decentralized finance (DeFi) has been birthed and nurtured by Web3, which allows one to both create and own content, along with blockchain, bitcoin (or other cryptocurrencies), and non-fungible tokens. No longer will big banks run by stodgy old hedge fund masters, able to control development or decide winners and losers in business, philanthropy, or even politics.

While many, especially those who have governed finance for centuries, see these disruptive technologies as dangerous scams that threaten the status quo, serial entrepreneurs like Chase Ergen see them as liberators and enablers that can inspire people to new levels of personal and societal achievement.

For example, but one trio of innovators has developed blockchains capable of integrating artificial intelligence, while another is democratizing access to zero-knowledge proofs for developers. Others have begun to tokenize intellectual property, while others have focused on tokenizing everything from real estate, to gold, to human capital.

The mistakes made by early blockchain innovators like Sam Bankman-Fried (‘SBF’) in past years have served as guiding lights for this, the 2025-era second generation that has focused much more on providing a safer investment environment, including asset-backed coins and better tracking using blockchain.

However, seemingly the entire world of decentralized finance is focused today on a legal battle taking place in Texas, as innovators are challenging the Internal Revenue Service (IRS) and the Treasury Department’s controversial “broker” rule as unconstitutional.

The lawsuit filed by the DeFi Education Fund, the Blockchain Association, and the Texas Blockchain Council claim these federal agencies are stifling innovation in one of the most groundbreaking industries of our time.

This battle, which with the future-oriented Trump Administration in place is likely to result in a defeat for the old guard at IRS and Treasury, is what Forbes calls “a reflection of the tension between the regulatory frameworks of traditional financial systems and the disruptive force of new technologies like decentralized finance (DeFi)”.

DeFi, by design, Forbes says, is an industry which operates without a central authority and thus enables individuals to engage in financial activities – lending, borrowing, and trading – without relying on intermediaries like banks.

No wonder the Old Guard is fighting the technology – it makes them irrelevant.

It is, however, not regulation per se but regulation that stifles rather than creates level playing fields for wide-open competition; a scenario that frustrates this new generation and entrepreneurs like Chase Ergen, who, like other American entrepreneurs, would like to be able to operate in his own country.

The IRS-Treasury rules (enforced by the Securities and Exchange Commission or ‘SEC’) create a regulatory framework that has already driven many developers and entrepreneurs overseas to countries like the UAE and the Bahamas. This “broker” rule is seen almost as sabotage crafted by old-line bankers to thwart the growth or even kill off decentralized finance altogether.

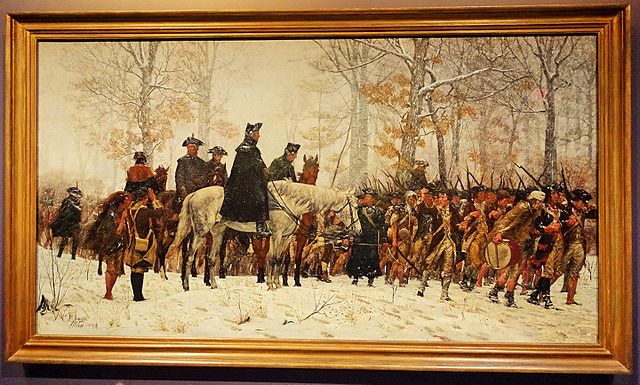

For a comparison, visualize horse-and-buggy drivers standing in the way of the automobile.

As Miller Whitehouse-Levine, CEO of the DeFi Education Fund, says, “Decentralized Finance writ large promises to make financial services and the digital economy more accessible, efficient, interoperable, dependable, and consumer-focused.”

Ergen, like many other emergent entrepreneurs, moreover has plans this year for new ventures that are still in development.

With his stature and breadth of knowledge, he – like many others worldwide who are changing the future of finance and business itself – will be one to watch.