Please Follow us on Gab, Minds, Telegram, Rumble, Truth Social, Gettr, Twitter

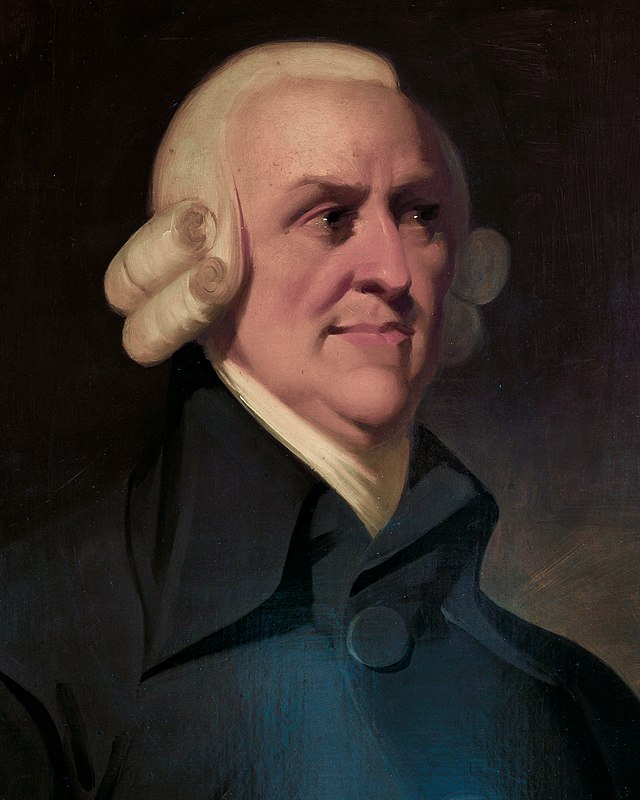

Doral, Florida - Last Thursday evening in Miami-Dade College, Wolfson campus, the Economic Club of Miami (a new and surging competitor to similar economic clubs in New York, Chicago and elsewhere) hosted an analysis of America’s market economy on the occasion of Adam Smith’s 300th birthday, and also took the opportunity to give a few prognostications on the best investments over the next year or so.

Worldly Philosopher

Adam Smith founded the study of free-market capitalist economics with the publication during 1776 in Edinburgh, Scotland, of his book, An Inquiry into the Nature and Causes of the Wealth of Nations: https://www.amazon.com/Wealth-Nations-Adam-Smith/dp/B09KN7ZNFJ/ref=sr_1_7?crid=376CDWQG7BPOW&keywords=adam+smith+wealth+of+nations&qid=1694615903&s=books&sprefix=adam+smith+%2Cstripbooks%2C116&sr=1-7. Smith attended college in Glasgow, Scotland, and Oxford, England, before accepting a professorship at UGlasgow when he was 28 years old. Thereafter he moved to France to serve as tutor in the household of the future Chancellor of the Exchequer of Great Britain. During his time in France, he met with Benjamin Franklin, David Hume and Voltaire. He may have lived an uneventful scholarly lifestyle, but he was a worldly philosopher.

Smith was the first philosopher to observe that wealth is created through productive labor, which requires the division of labor, interconnected by contractual relations. He was the first to use the term “invisible hand” to describe how free markets can incentivize individuals, acting in their own self-interest, to produce what is demanded by society. He observed that it is not from the benevolence of the butcher or baker that we may expect our dinner, but from their regard to their self-interest.

Smith was also the first to emphasize the benefits of free trade, which were later expanded upon by the economist David Ricardo. Free trade, especially when reciprocal and with friendly counter-parties, can increase the well-being of both participating parties. He argued that profits flow from capital investments, so therefore capital should be invested where the most profit can be made. He stands behind the proposition that respect for private property, competition among various providers, and a sound currency are the best policies for economic growth. He is considered the father of modern economics and laissez faire policies.

Investment Outlook

The discussion at the Economic Club of Miami was led by Rodolfo Milani, a veteran investment advisor: https://mail.google.com/mail/u/0/?zx=lmaxuj6i72ph#search/economic+club+of+miami/FMfcgzGtwzlvZbVpLxzzxmKhKtbXlnnL. He is a Senior Managing Director at B. Riley Wealth Management in Miami. Rodolfo draws most of his clients from Latin America, where a weak rule of law means that investments and savings are never safe from devaluations, expropriations and other depredations on private property by the state.

Miami is a hub for refugees from Latin America, starting with the Cuban diaspora since 1959, continuing to the new Venezuelan diaspora since around 2004, concentrated in Doral, Florida. See: https://miamiindependent.com/the-spirit-of-59-and-the-free-state-of-florida/. They invest their savings in American stocks, bonds and other assets.

Rodolfo has been a political activist since high school, but he, like many others, recognized during the Reagan presidential campaign of 1980 that he is a libertarian conservative Republican. Today he hosts monthly meetings of the Miami Freedom Forum, an affiliate of Grover Norquist’s Americans for Tax Reform.

Last Thursday evening, he moderated a panel of distinguished economists: (1) Mark Skousen, founder of the annual Freedom Fest events and fellow at Chapman University, California; (2) Ivan Martchev, strategist at Navellier Calculated Investing in New York; and (3) Paul Dietrich, chief investment strategist at B. Riley Wealth Management also in New York. The discussion was introduced by Francisco Gonzalez, Executive Director of the Economic Club of Miami, and Robert Foran, Professor of Economics in Miami Dade College.

Rodolfo asked the three economists to address specific questions, and they more or less answered as economists usually do: (1) Does the stock rally that we saw in the first half of this year resume in the last quarter? No, the stock rally will come to an end later this year. (2) Were the bank failures earlier this year (three of the four biggest bank failures ever to occur in the United States) isolated cases? No, higher interest rates have caught many financial institutions with unprepared portfolios, and especially regional banks will continue to fail. (3) Is the Federal Reserve likely to get it right on inflation, or will they overshoot? No, the Fed does not know what it is doing with inflation, and instead of overshooting, it is more likely to undershoot, stop raising interest rates, then inflation will start up again, and the Fed will have to play catch-up.

Also, (4) Will there be a recession or not? Will there be a soft or hard landing? There will be a recession next year, with a harder landing than everyone would like. (5) The United States consumer is more indebted than ever. Can he keep fueling the economy on credit card debt? No, the consumer will run out of purchasing power later this year. (6) The national debt is now over $30 trillion, which is $250,000 per taxpayer. How does this get resolved? It has to stop. What can’t go on forever, doesn’t! (7) What effect will a Chinese economic meltdown have on the world economy? Depression. (9) Will commercial real estate crash later this year, taking down the banking sector? Yes. There was no unanimity among these economists, of course, but Rodolfo and Mark were less negative on the stock market outlook than Ivan and Paul.

In addition, Mark observed that excessive government borrowing is leading us to a crisis, especially because the United States Dollar has been totally unhinged from the gold standard since the Nixon administration in 1971. Ivan focused on the higher interest rates of the last couple of years, which is likely to cause a banking crisis related to commercial real estate. As a result of the foregoing concerns, Paul forecast a recession by next year, starting in the first quarter, and predicted that the Standard & Poor’s 500 stock index will decline by some 25% during that recession. However, as Professor Jeremy Siegel of Wharton business school reminds us, it’s stocks for the long run.

Classical Liberalism

Mark Skousen is not only an investment advisor, but also a teacher of economics. He is the author of The Making of Modern Economics, now in its fourth edition out last year: https://www.amazon.com/Making-Modern-Economics-Fourth-Thinkers/dp/B09XVJ962D/ref=sr_1_1?crid=2QOZPVOMYXWM1&keywords=mark+skousen+the+making+of+modern+economics&qid=1694807020&s=books&sprefix=mark+skousen+the+makin%2Cstripbooks%2C105&sr=1-1. He has taught at Columbia University, Barnard College and now Chapman University, and he made the connection between the principles espoused by Adam Smith, and the results of economic growth.

Professor Skousen pointed out the key to economic growth set forth in the writings of Adam Smith: “Every man, as long as he does not violate the laws of justice, is left perfectly free to pursue his own interest in his own way, and to bring both his industry and capital into competition with those of any other man.” This model produces higher economic growth, benefits for all, rich and poor, and economic stability.

He also pointed out that this classical liberal model relies on: (1) entrepreneurship and supply-side dynamism; (2) limited government; (3) balanced budgets and low taxes; (4) sound money with no inflation; and (5) free trade. It has produced an astronomical increase in economic prosperity since Adam Smith’s time.

On the other hand, the Professor acknowledges that economic freedom has been declining in the United States since the first quarter of 2020, when lockdowns were imposed in response to the Wuhan flu virus. Adam Smith understood that such setbacks to economic growth could occur, and he observed that: “The uniform, constant and uninterrupted effort of every man to better his condition…is frequently powerful enough to maintain the natural progress of things toward improvement, in spite both of the extravagance of government, and the greatest errors of administration.” Today we are living in an excess of such extravagance and errors.